Does American Tower REIT Deserve a Place in Your Portfolio?Leading global REIT American Tower (AMT) has made significant advancements in expanding its communications real estate footprint to capitalize on rapid 5G deployment in the U.S. and Europe. However, given...

ByImon Ghosh•

这个年代tory originally appeared onStockNews

Leading global REIT American Tower (AMT) has made significant advancements in expanding its communications real estate footprint to capitalize on rapid 5G deployment in the U.S. and Europe. However, given that interest rate fears and a heavy debt load could weigh heavily on its stock price, will AMT be able to maintain its market standing? Read on. Here's what we think.

Boston-based real estate investment trust American Tower Corporation (AMTac)提供无线通信基础设施ross 25 countries located on six continents. Accelerating growth in the company's organic tenant billings across each segment and a substantial increase in demand for 5G solutions in the U.S. and Europe have benefited the REIT significantly. Its total property revenue was up 22.1% year-over-year during the first quarter of 2022, driven by growing carrier network investments.

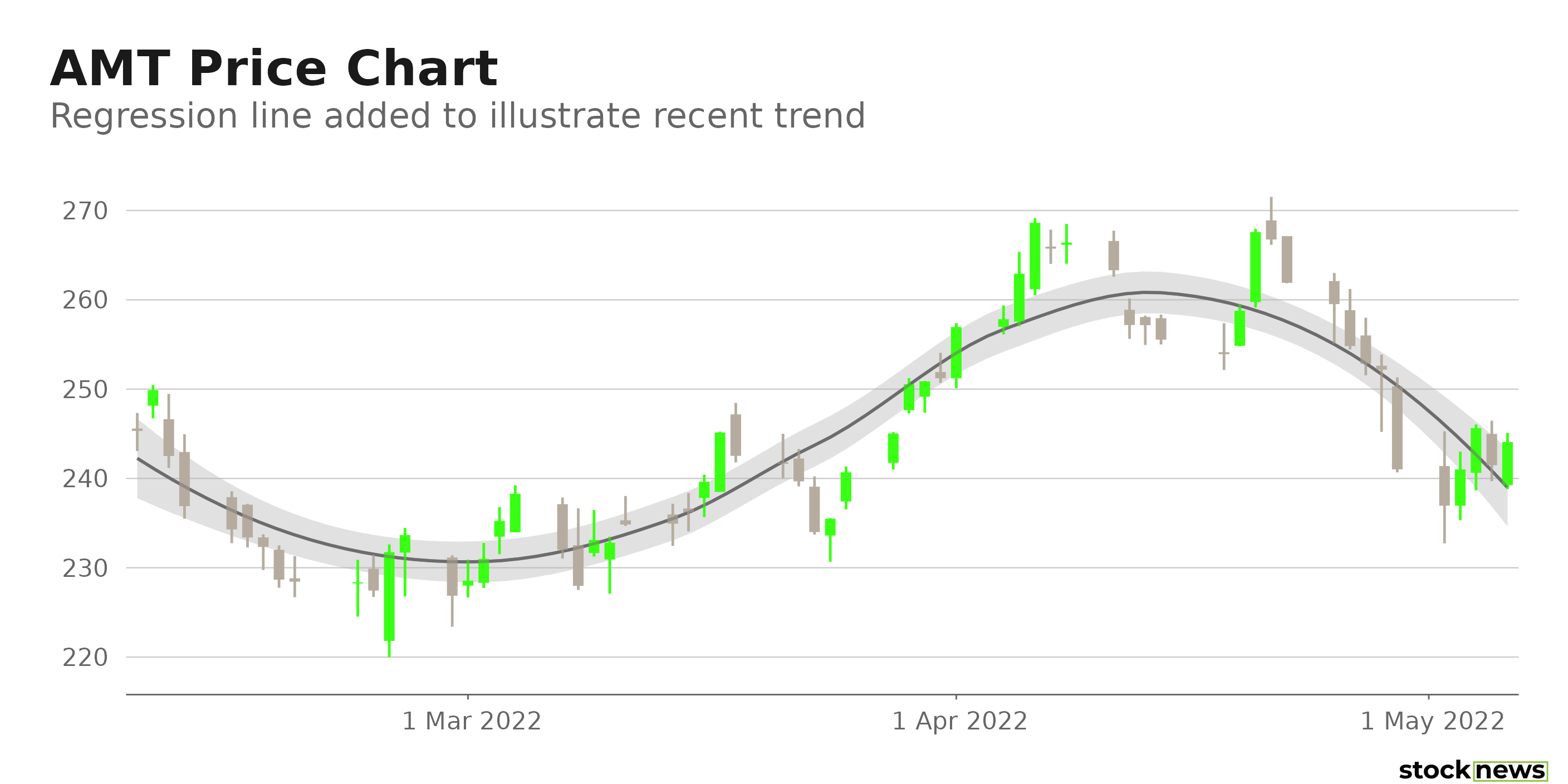

However, the stock has declined 9.1% in price over the past month to close its last trading session at $244.07. Furthermore, its shares have declined 16.6% so far this year. Amid a broader market selloff, as investors remain worried about the war in Ukraine and high inflation, real estate stocks could continue to take a beating.

While the rapid acceleration in mobile data consumption and rising 5G infrastructure deployments should strengthen AMTs position in the market, its substantial cash burn and fears surrounding rising interest rates could spook investors.

Here is what could influence AMT's performance in the coming months:

Growing Deployment of 5G Network

A growing 5G-enabled smartphone base and the rising need for faster speeds for smartphones have been driving the 5G infrastructure market. The 5G technology market is estimated at $ 9.6 billion in 2022,and is expected to register a 71.9% CAGRduring 2022 – 2028. Heavy investments in 5G infrastructure by the government, and the growth in wired and wireless subscriptions, should further propel the 5G technology market. This should be a boon for the leading communications real estate operator AMT as it positions itself to capture the benefits of the emerging 5G trends.

Near Term Headwind

The Federal Reserve increased its benchmark interest rate by 50 basis points this month. While Fed Chair Jerome Powell said recently that the central bank is "not actively considering" a 75-basis point increase in rates, the prospect of further rate hikes to control inflation remains. This could negatively impact REIT stock AMT because REITs are expected to underperform in a higher interest rate environment, which tends to decrease the value of properties and increase REIT borrowing costs.

Mixed Growth Story

The $0.99 consensus EPS estimate for the current quarter, ending June 30, 2022, indicates a 40% decline year-over-year. Furthermore, its EPS is expected to decline 34.8% next quarter and 20.1% in its fiscal year 2022. But analysts expect AMT's revenues to grow 20.1% year-over-year to $2.65 billion in the current quarter and 14% in the current year.

AMT's revenue increased at a 9.5% CAGR over the past three years. And its total assets grew at an annualized 21.5% over this period.

Unstable Financials

During the first quarter ended March 31, 2022, AMT reported $2.66 billion in total revenue, representing a 23.2% year-over-year increase, primarily attributable to its rise in property revenue. But its cash provided by operating activities declined 39.3% year-over-year to $664 million. The company's free cash flow declined 64.5% from the prior-year period to $269 million. And although itsadjusted EBITDArose 12.8% from the year-ago value to $1.62 billion, AMT's total debt stood at $43.46 billion as of March 31, 2022.

POWR Ratings Reflect Uncertainty

AMT has an overall C rating, which translates to Neutral in ourPOWR Ratingssystem. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. AMT has a D grade for Growth. This is in sync with the stock's mixed financials and growth prospects.

In terms of Value grade, AMT has a D. The stock's 55.14x P/E ratio, which is 48.5% higher than the 37.14x industry average, is consistent with the Value grade.

In addition to the grades I have highlighted, one can check out additional AMT ratings for Sentiment, Stability, Momentum, and Qualityhere. AMT is ranked #31 of 50 stocks in the C-ratedREITs - Diversifiedindustry.

Bottom Line

While the growing deployment of 5G infrastructure and improved tenant billing growth bode well for AMT, the stock's upside could be limited given rising interest rate concerns and the company's heavy debt load. Therefore, we think investors should wait for the situation to stabilize before investing in the stock.

How Does American Tower Corporation(AMT) Stack Up Against its Peers?

While AMT has a C rating in our proprietary rating system, one might want to consider taking a look at its industry peer, One Liberty Properties, Inc. (OLP), which has an A (Strong Buy) rating.

AMT shares were unchanged in premarket trading Monday. Year-to-date, AMT has declined -16.11%, versus a -13.13% rise in the benchmark S&P 500 index during the same period.

About the Author: Imon Ghosh

Imon is an investment analyst and journalist with an enthusiasm for financial research and writing. She began her career at Kantar IMRB, a leading market research and consumer consulting organization.

The postDoes American Tower REIT Deserve a Place in Your Portfolio?appeared first onStockNews.com