OMG: 5 Investors/Groups Who Passed on Brilliant Ideas ... and on Windfalls Worth MillionsWho could have foreseen that the Beatles would become the biggest rock band of all time?

Opinions expressed by Entrepreneur contributors are their own.

Have you ever missed out on a huge opportunity? Maybe you sold some Bitcoin right before the price explosion late in 2017, or said no to a job offer at a tech startup whose employees eventually cashed out hundreds of thousands in stock.

Related:25 Reasons I Will Not Invest in Your Startup

If you're one of these poor souls, you can take comfort in knowing you're not alone. The missed opportunities of others serve as evidence that sometimes, even the best ideas appear worthless at first glance.

Take, for example, these investors and entrepreneurs, who passed on big ideas -- and may have cost themselves a fortune in the process.

1. Ron Wayne could have been worth over $100 billion.

A billion dollars is hard to picture. Try to imagine$100 billion. That's the size of the fortune that Ron Wayne could have had if he'd made a slightly different decision 40 years ago. Back in 1976, Waynesigned Apple's partnership agreement与乐阁ndary duo Steve Jobs and Steve Wozniak; the agreement would have granted Wayne a 10 percent stake in the company.

Wayne went on to write the manual for Apple I and sketch the first Apple logo; he considered himself responsible for keeping an eye on the other two -- the "crazy ones."

But after just 12 days with the company, he could no longer stand working with his co-founders and sold his share for a mere $800. Today, withApple's valuation now over $1 trillion, Wayne's stock share would have been worth over $100 billion. Still, he says he regrets nothing, as his departure gave him the chance to work on things he actually loved.

2. Scott Tobin and Battery Ventures walked away from Facebook.

Battery Ventures, a Boston-based venture capital firm, had thechance to invest in Facebook back in 2004, long before the platform exploded in popularity. Mark Zuckerberg had already created the platform in his Harvard dorm room and might have been happy to stay in Boston had he had the money and support to do so.

Related:It Made Sense at the Time: Why I Passed on Uber's Seed Round

But, in actuality, Battery Ventures passed on Facebook, so Zuckerberg moved west and earned his other investors a fortune. Scott Tobin, a partner in Battery Ventures would later admit that his company's decision involved "a generational issue.

"You couldn't really understand social networking here," Tobin said. "To understand things like Facebook, you [had] to be 19 to 24 years old. If you [were] 56, you [didn't] quite get it."

3. Chris Hill-Scott got a bicycle instead of a fortune.

Chris Hill-Scott, one of thethree co-founders of SwiftKey,发现很难跟上民主党ands of the business back in 2008. Ready to part ways, and uncertain about the business's future, Hill-Scott sold his stake in the company for a bicycle. The other co-founders kept working, however, and eight years later, managed tosell SwiftKey to Microsoft for $250 million, with each of the co-founders pocketing $50 million.

And all Hill-Scott got was that lousy bicycle.

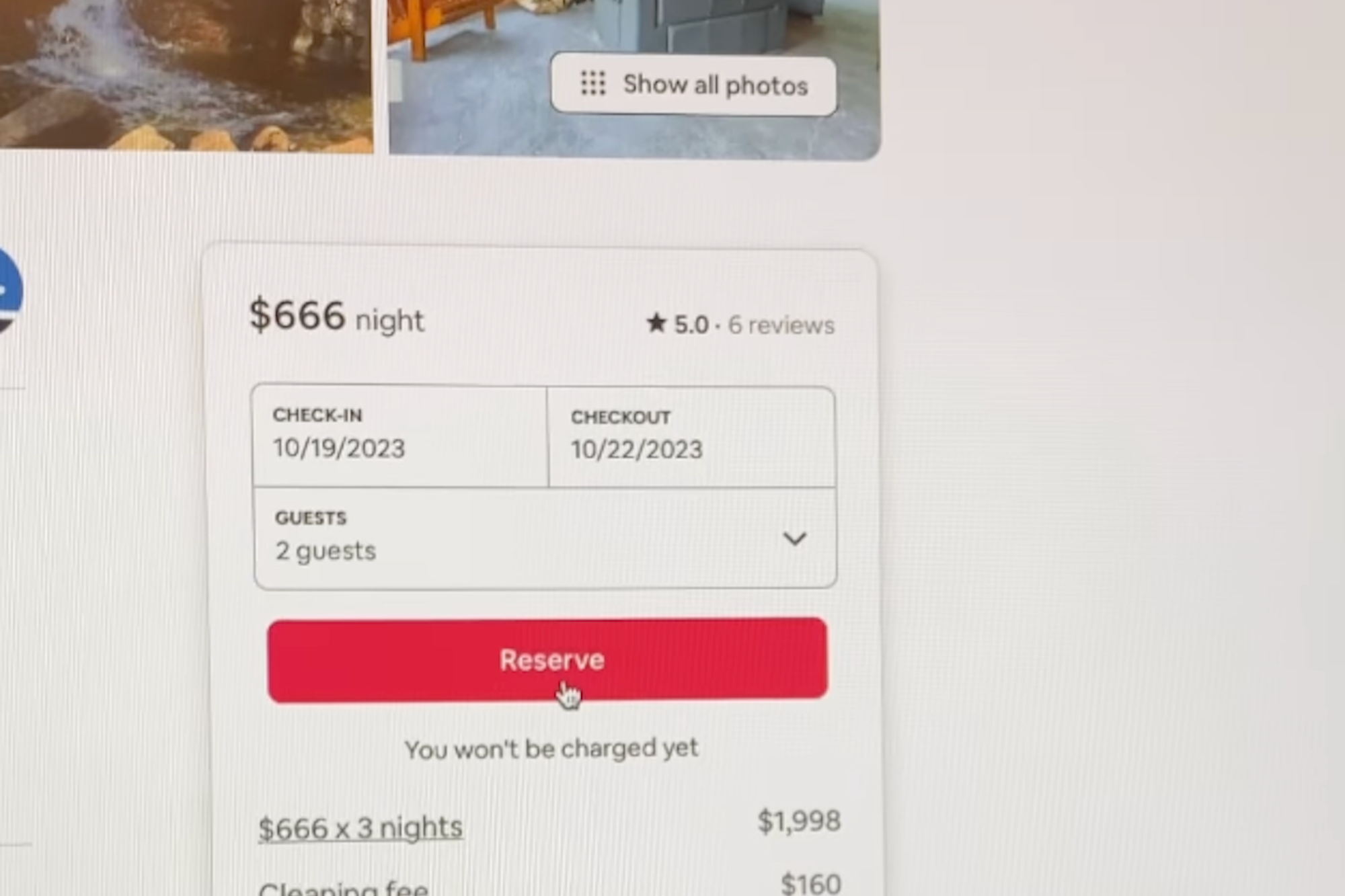

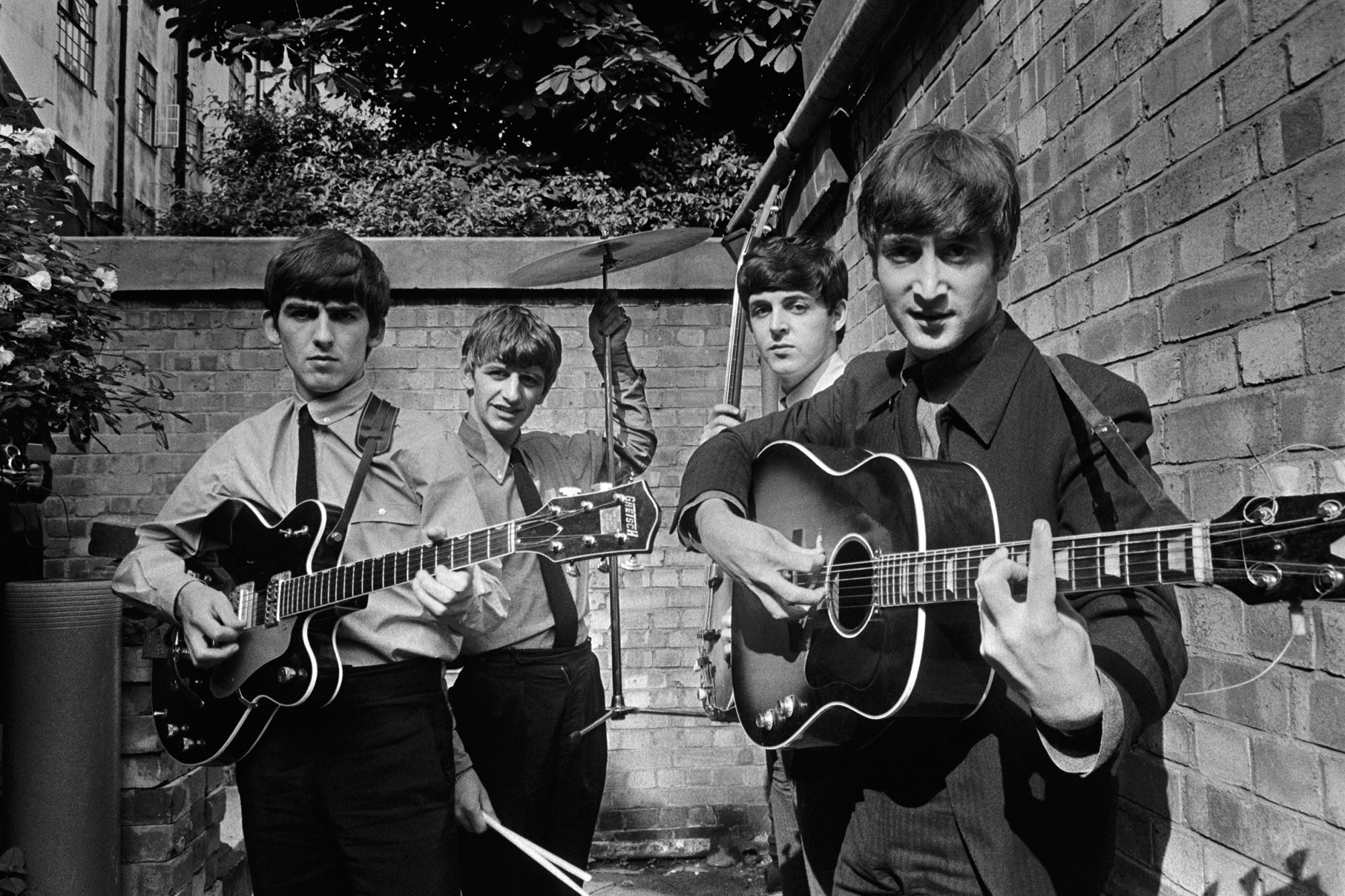

4. Decca Records passed on the Beatles.

Though not the decision of a sole individual, the Decca Records fiasco early in the Beatles' careers demands a mention. In 1962, before the Liverpool quartet became superstars and arguably, the most important rock band of all time, the guysauditioned to be signed with Decca Records.

The audition went well and producer Mike Smith verbally acknowledged that fact, but a few weeks later, the group got a rejection letter that informed them, "Guitar groups are on the way out" and, "The Beatles have no future in show business." Today, it's hard to read those statements without laughing.

5. Bessemer Venture Partners passed on several big companies.

Bessemer Venture Partners is a successful venture capital firm, but that doesn't mean all its decisions have been flawless. But at least they're humble enough to admit it. The companypublishes an "anti-portfolio"of companies it could have invested in but never did, as an amusing lesson in the wacky nature of entrepreneurship and venture capitalism.

For example, a BVP investor's college friend rented her garage to Google co-founders Sergey Brin and Larry Page during the duo's first year of operations. This woman tried to make an introduction but, suspecting an amateurish operation, investor David Cowan told her, "How can I get out of this house without going anywhere near your garage?"

Did all these investors make "bad" decisions? Not necessarily. Most of them made the best decisions they could, given the information they had at the time. Yet hindsight is 20/20; and, in the moment, there's no guarantee that a plucky startup with respectable potential is going to become an international sensation.

So, take some inspiration here: If you're getting rejected early on, know that there's a chance for success even when top experts think you don't have a chance. And if you're on the investing side, think twice before passing on that next opportunity.